News

Firstmonie Agents Transact Over 1 Billion Transactions, Reinforces FirstBank’s Leading Role In Promoting Financial Inclusion In Nigeria

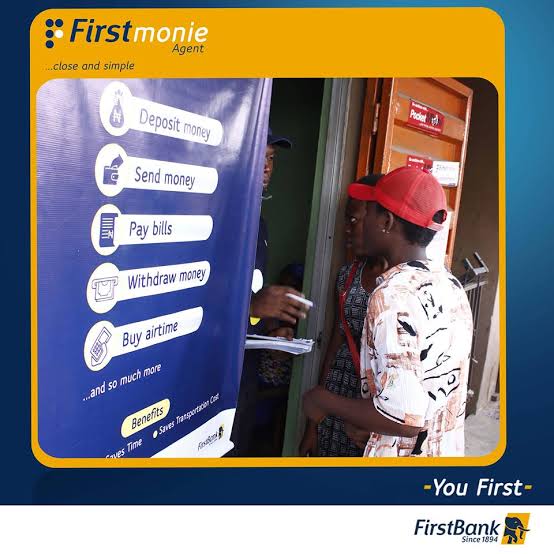

The Bank’s Firstmonie Agents play a critical role in promoting financial inclusion in the country

• The Bank currently has over 180,000 Firstmonie Agents spread across 772 Local Government Areas in Nigeria

• Since 2020, FirstBank has economically empowered thousands of its Firstmonie Agents with over 100 billion naira credit facility

First Bank of Nigeria Limited, Nigeria’s premier and leading financial services provider has announced that its agent banking network – Firstmonie Agents – spread across the nook and cranny of the country has collectively processed transaction volume in excess of 1 billion, amounting to over 22 trillion naira. The Bank currently has over 180,000 Firstmonie Agents, spread across the country’s 772 Local Government Areas.

Firstmonie Agents have been integral to bringing financial services closer to the underbanked and unbanked segment of the society, providing convenient banking services that are easily accessible, thereby saving time and travel costs for individuals in the suburbs and remote environments with no access to financial services.

Popularly referred to as the ‘Human ATM’, Firstmonie Agents are empowered to reduce the reliance on over-the-counter transactions while providing convenient personalized services. Amongst the services carried out by the Agents include; Account Opening, Cash Deposit, Airtime Purchase, Bills Payment, Withdrawals and Money Transfer.

Through various empowerment and reward schemes implemented to put its Firstmonie Agents at an advantage to economically impact their immediate communities whilst importantly having their business sustained, the Bank’s Agent Banking scheme has remained a toast to Nigerians, irrespective of where they are in the country. Amongst these schemes is the Agent Credit – launched in 2020 – which has had the Bank provide credit facilities to the tune of 238 billion naira to its teeming Firstmonie Agents.

Expressing his appreciation to the Firstmonie Agents, Dr. Adesola Adeduntan, CEO, FirstBank said “since the relaunch of our Agent Banking scheme in 2018, our Firstmonie Agents have played a vital role in bridging the financial inclusion gap in the country, as many more people have been able to undertake various financial and business transactions in cost-effective ways, thereby saving a lot of time and money in travelling over long distances for basic banking services.“

“We are delighted by the giant strides of our Firstmonie Agents in promoting financial inclusion and commend them for their efforts in taking banking to the doorsteps of Nigerians – irrespective of where they are – in a very effective way”, he concluded.

-

Society News4 years ago

Jamaican man beheads wife after finding out their 6 kids are not his

-

Society News6 years ago

EXCLUSIVE: The Complete Story of Dolapo Awosika, John Fashanu and Prophet Kasali Sex Mess

-

News4 years ago

Pastor Osagie Ize-Iyamu, His Membership Of Secret Cult, And Other Issues Touching On His Public Credentials Examined by Barr. PATRICK I. BIOSE

-

News4 years ago

BREAKING: Ajimobi’s daughter-in-law blast Gov. Makinde, says gov can’t surpass ex-Oyo gov

-

News4 years ago

BREAKING: 2 arrested as NAF begins investigations into Tolulope’s death

-

Crime5 years ago

Exclusive: Female Aide Fingered In Oko Oloyun’s Murder + Banking Transactions That Nailed Husband

-

News4 years ago

BREAKING: Police take over Edo House of Assembly as APC, Oshiomhole move to seize control

-

Society News5 years ago

The Rise and Fall of “Jumoke The Bread Seller”

You must be logged in to post a comment Login