Featured

Urgent Call For The Use Of Naira As The Only Legal Currency In Nigeria and To End Other policies That Unfairly Disadvantage The Naira

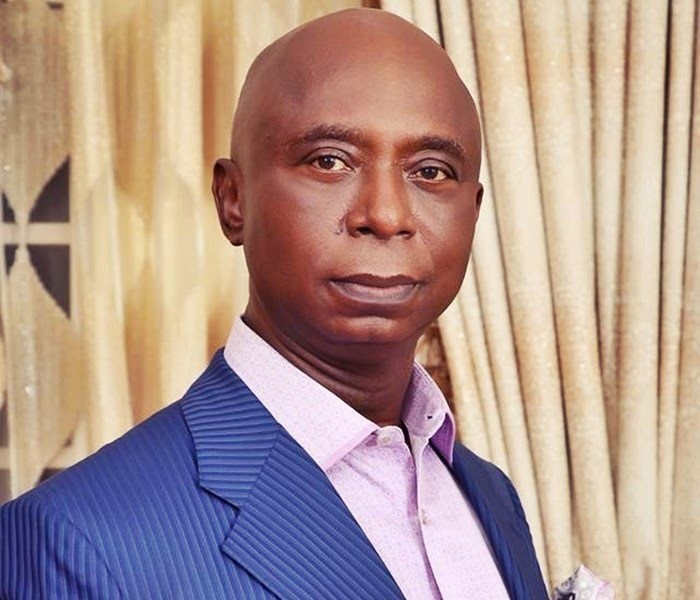

By

Ned Nwoko

The glaring income inequality between foreign workers and their Nigerian counterparts within companies operating in Nigeria is a deeply concerning practice that perpetuates historical injustices rooted in the colonial legacy. This practice exacerbates existing economic disparities and reinforces the master-servant dynamic that has plagued the region for centuries.

Colonial Legacy and Economic Exploitation:

Historically, income inequality in Africa, including Nigeria, has been entrenched since the colonial era. European settlers exploited the vast resources of the continent while systematically marginalizing and impoverishing indigenous populations. This exploitation was not only economic but also deeply ingrained in social and political structures, leading to a stark income gap between Africans and their colonial overlords.

During colonial rule, Africans were often relegated to low-paying labour roles while Europeans enjoyed privileged positions with significantly higher incomes. Of course this disparity was not based on merit or skill but rather on race and colonial power dynamics.

Unequal Treatment in the Present Day:

Even after gaining independence, the remnants of this unequal system persist, manifesting in the unequal treatment of foreign workers and local employees in Nigeria. The payment of foreign workers in dollars, while Nigerian colleagues receive wages far below the conversion rate, is a blatant example of this ongoing injustice.

The consequences of this practice extend beyond mere discrimination; they have profound implications for Nigeria’s economy as seen today. The alarming depreciation of the Naira against the dollar is exacerbated by the demand for foreign currency to pay professional services in dollars. This not only erodes confidence in the domestic currency but also widens socioeconomic disparities within the country.

Legal Ambiguity and Regulatory Reform:

Distressingly, the absence of explicit prohibition on paying salaries in foreign currency in relevant legislation, such as the Central Bank of Nigeria Act and the Foreign Exchange Act, heightens regulatory ambiguity and allows such exploitative practices to persist unchecked. Urgent amendments to these laws are imperative to address this issue effectively and ensure equitable treatment of all workers in Nigeria.

The significant capital flight resulting from these unequal salary payments far surpasses most factors contributing to Naira depreciation, such as school fees and medical treatments abroad. Ending the practice of paying foreign workers in dollars is not only a matter of economic justice but also a crucial step towards dismantling neocolonial structures and building a more equitable and prosperous Nigeria for all its citizens.

Reconsidering “Foreign” Reserves Policy:

The notion of maintaining reserves in foreign lands, dubbed “foreign reserves,” is not only repulsive but also counterintuitive to Nigeria’s economic sovereignty. Contrary to the practices of other nations like the United States, Britain, France, and Japan, which keep their reserves within their own borders, Nigeria’s adherence to this practice raises questions about its colonial legacy. If our early indigenous leaders adopted this approach due to colonial mentality, why should we perpetuate it?

The primary argument often put forward to defend the existence of foreign reserves is the need to balance trade. However, this argument lacks merit when considering the limited number of traders involved in importing goods into Nigeria, which constitutes a negligible fraction of the population. Therefore, the notion that foreign reserves are necessary for trade balance falls short when scrutinized.

It’s time to prioritize the domestication of our reserves, anchoring our economic stability firmly within our borders.

Stimulating Demand for the Naira:

If we don’t get our currency to be needed, valued, known, and quoted, no one is coming to do it for us. Continued acceptance of the dollar as legal tender undermines our economic sovereignty and must be halted. We must stop giving people the confidence to conduct business in Nigeria using foreign currencies. This practice not only undermines our economy but also perpetuates dependency on foreign currencies.

As a nation that sells crude oil and a few other items on the global market, it’s crucial that we make it compulsory for every sale of these items to be conducted in Naira. This will prompt buyers to seek out Naira, leading to its appreciation due to increased demand and scarcity.

While we may not have a large volume of exports on the global market, we attract a significant number of visitors. When these visitors understand that the dollar will not be accepted as legal tender in Nigeria, they begin sourcing Naira from their commercial banks and Bureau de Change (BDCs) even before arriving in the country. This increased demand prompts banks abroad to source and stock up Naira, making it readily available for exchange.

Upon arrival, visitors can also obtain Naira from our BDCs. Imagine millions of visitors and prospective visitors from all over the world sourcing Naira; our local currency becomes increasingly relevant. This scenario creates a simple supply-and-demand dynamic, where the demand for Naira increases, making it more relevant globally. If we fail to create a need for Naira in other nations, their BDCs won’t even recognize it, let alone accept it for exchange. We must create an atmosphere that encourages the demand for Naira. This involves adopting policies that mandate the use of Naira for business transactions. Additionally, all domiciliary accounts must be converted into Naira.

Redefining the Role of Bureau de Change (BDC):

The prevalence of Bureau de Change (BDC) facilities in Nigeria must align with currency policies aimed at shunning unfairly fall of the Naira. BDCs should serve as facilitators of currency exchange for foreigners, promoting the use of the Naira in domestic transactions. By enforcing regulations that prohibit the acceptance of foreign currencies for local transactions, we redirect the focus of BDCs towards selling Naira and retaining foreign currencies for outbound travelers. Ambiguous practices, such as students paying school fees abroad, must also be addressed by BDCs in commercial banks.

Challenges and Resolutions:

Opposition to these reforms may arise, particularly from oil companies and other corporations with agreements that could hinder the implementation of the proposed measures and hinder progress. However, agreements do not equate to immutable judgments. Any existing agreements will be thoroughly reviewed, and any unjust or unfair ones will be amended or terminated in favor of the collective economic growth of the nation.

If we truly desire economic freedom, then reassessing Nigeria’s approach to reserves and currency policy is imperative to pave the way for economic resilience and self-reliance.

As we grapple with the free fall of the Naira and the near-collapse of the economy, there is only one short-term, medium-term, and long-term solution, which is captured in my motion and bill before the Senate titled “Urgent Call for Immediate Prohibition of the Use of Foreign Currencies in Nigeria” and “Bill for an Act to Alter the Central Bank of Nigeria Act, 2007, to Provide for the Prohibition of Foreign Currency Payment for Remuneration and for Matters Connected Therewith.”

_ Senator Ned Munir Nwoko (Delta North), Solicitor, Supreme Court of England and Wales

-

Society News5 years ago

Jamaican man beheads wife after finding out their 6 kids are not his

-

Society News7 years ago

EXCLUSIVE: The Complete Story of Dolapo Awosika, John Fashanu and Prophet Kasali Sex Mess

-

News5 years ago

Pastor Osagie Ize-Iyamu, His Membership Of Secret Cult, And Other Issues Touching On His Public Credentials Examined by Barr. PATRICK I. BIOSE

-

News5 years ago

BREAKING: Ajimobi’s daughter-in-law blast Gov. Makinde, says gov can’t surpass ex-Oyo gov

-

Society News6 years ago

The Rise and Fall of “Jumoke The Bread Seller”

-

News5 years ago

BREAKING: 2 arrested as NAF begins investigations into Tolulope’s death

-

Crime6 years ago

Exclusive: Female Aide Fingered In Oko Oloyun’s Murder + Banking Transactions That Nailed Husband

-

News5 years ago

BREAKING: Police take over Edo House of Assembly as APC, Oshiomhole move to seize control

You must be logged in to post a comment Login